Science of Wealth Management ™

When executives, business owners, professionals and their families come to us for advice, they are typically looking for not only how to make the most of their financial circumstances, but how to make the most of their lives:

- How can I build my business while setting aside personal wealth?

- When will I be financially independent?

- How can I best protect myself and my family against the unexpected?

Our Science of Wealth Management™ is dedicated to helping you identify, plan for and achieve your individual goals by tending to the means and the ends of your financial circumstances, with a three-pronged approach that is:

Research-Driven

Incorporating advanced research from leading academic and practitioner institutions including the CFA Institute, CPA Canada, AICPA Financial Planning Division, Wharton School and the University of Chicago, we assess your current and future financial abilities, identify opportunities for enhancing your financial independence, and formulate strategies to mitigate the risks that could impair it.

Integrated

Harnessing our depth and breadth of experience and alliances, we help professionals and their families address their financial interests by combining careful integration of the parts (investments, pensions, credit management, finance, insurance, taxes, and estate planning amongst others) with informed oversight of the whole.

Insightful

We are particularly well-positioned to address complex concerns across multiple disciplines, tapping into local expertise as well as global resources to present options and opportunities that may have been overlooked.

It’s much easier to achieve your goals once you’ve identified what they are. That’s why among our favorite questions to ask new clients is where they see themselves at various milestones in their lives:

-

- Where do you want to be, personally and professionally, in three years?

- After a decade?

- As you enter retirement?

We have structured our client processes accordingly.

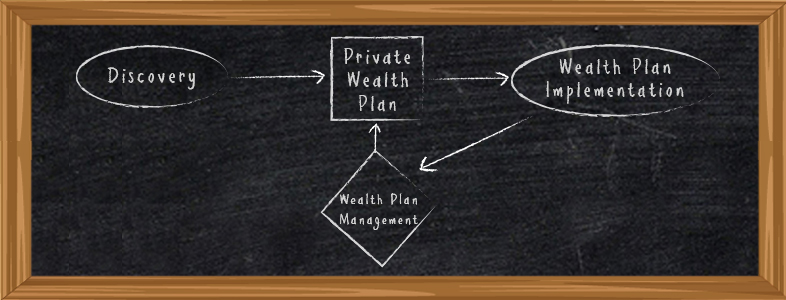

Discovery

During an in-depth fact-finding interview, you’ll share critical information with us, so we can build a complete understanding of your personal financial affairs.

Private Wealth Plan

Based on what we hear from you, we’ll present a detailed, written Private Wealth Plan that assesses your current and future financial abilities, opportunities for enhancing your financial independence, and strategies for mitigating the risks that could impair it.

Wealth Plan Implementation

With your plans in place, we’re ready to act: structuring your ideal investment portfolio, incorporating available tax strategies and assisting with appropriate risk management solutions, all with an eye toward optimizing your financial outcomes according to your individual goals and challenges.

Wealth Plan Management

Through the years, we help you stay on course toward your goals by regularly tracking, resolving and mitigating your personal high-risk issues and concerns, as well as by staying on top of changes in your life that may warrant changes to your Private Wealth Plan.

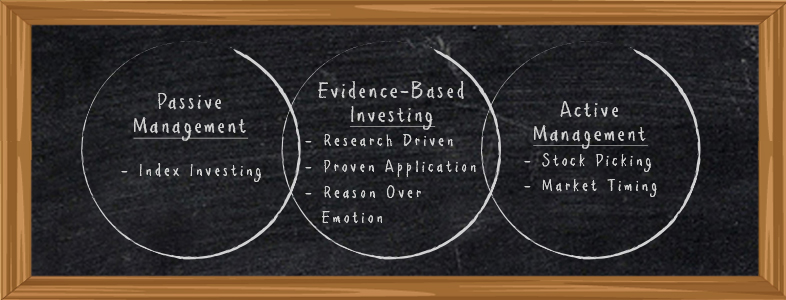

Just as our client relationships are driven by the Science of Wealth Management ™, our investment strategy is grounded in the robust evidence on how investors can expect to participate in the wealth produced by our capital markets. The sum total is further strengthened by our Thought Leadership engagements.

Evidence-based investing is grounded in decades of ongoing academic inquiry, bolstered by continued practical application. The results have informed us that long-term investors are best served when they are guided by reason rather than emotion, and by managing factors they can expect to control rather than reacting to those that they cannot.

This translates to three investment essentials around which we structure our strategy:

Market factors

How you allocate your portfolio across different market factors plays a far greater role in varying long-term portfolio performance than do the individual securities you hold. (Different factors have exhibited different levels of persistent risk and expected reward available to patient investors.)

Global diversification

Some degree of market risk is required to expect to receive market returns. But by diversifying across multiple market factors around the globe, we can dampen the overall risk necessary for pursuing desired returns.

Cost control

Minimizing investment costs is among the most powerful, readily manageable ways to enhance net returns.

- Build and maintain highly customized portfolios according to each family’sunique goals and risk profile – based on global diversification across evidence-based market factors.

- Encourage our clients to remain disciplined, staying on course toward their long-term goals, especially when markets move through highs and lows that subject us to behavioral temptations.

- Turn to low-cost investment solutions constructed accordingly to these same, evidence-based practices.