Difficult business planning and portfolio issues; over-concentrated, illiquid assets; complex structural or financial situations; lack of holistic expert advice; disparate, conflicting input.

Regulatory and compliance oversight impact personal financial dealings; corporate compensation packages requiring advanced expertise; challenging personal financial circumstances for you and your family … never enough time!

Responsibly stewarding and distributing trust assets to entitled beneficiaries; managing high-end investment, tax-planning, legal and structural issues and/or financial situations; coordinating multiple professional advisors.

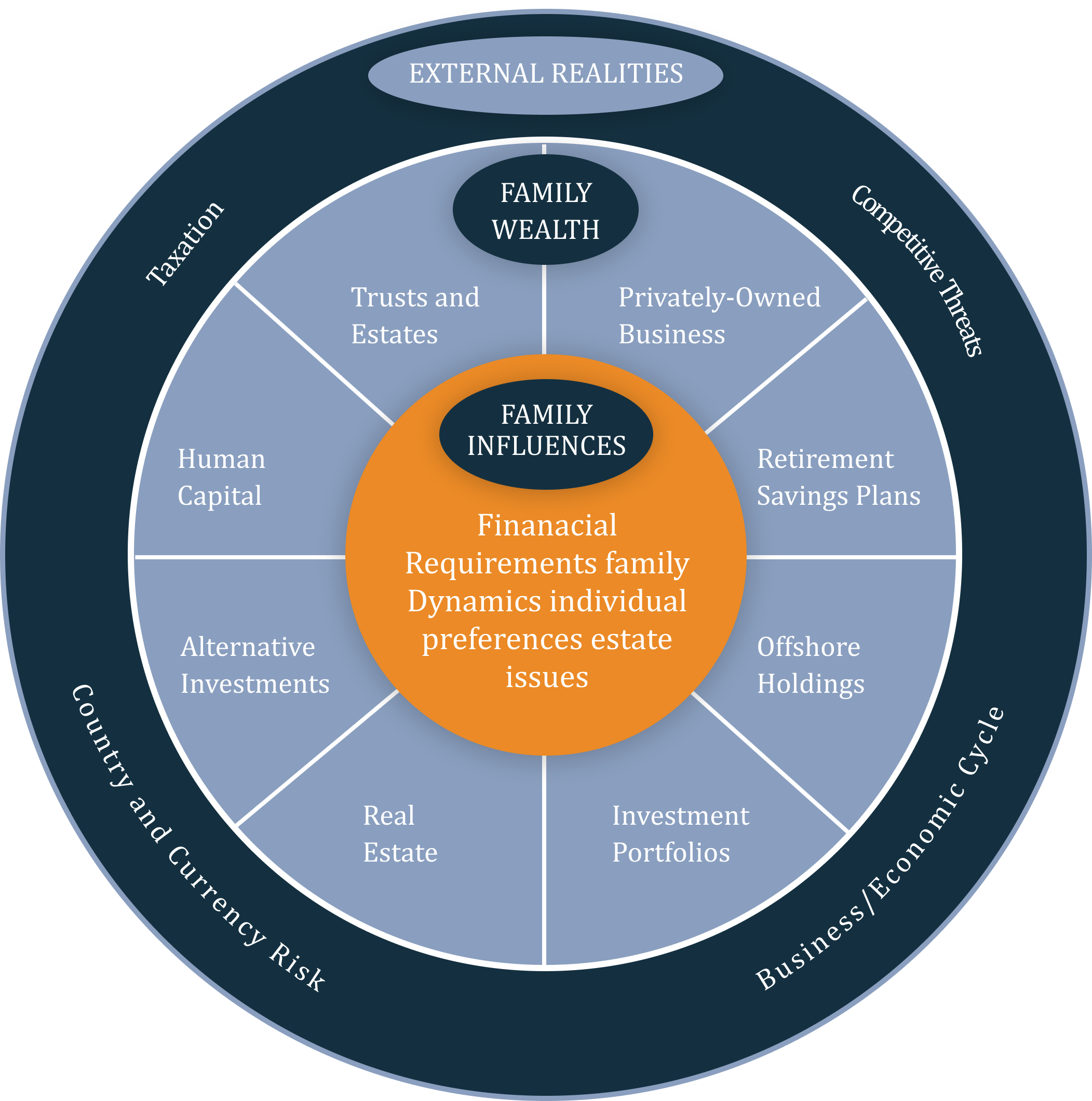

Managing myriad family influencers, family wealth components, business concerns and external realities toward realizing unique lifetime goals.

Serving business owners, senior executives and professionals, and trustees with advanced planning needs, we offer informed oversight to enhance families’ personal financial well-being: Saving time, adding convenience, creating clear strategy and ensuring expert implementation in the face of complex challenges.

As a professional Portfolio Management firm, we are positioned to take on your highest financial interests creating, executing and overseeing highly customized, integrated financial strategies to guide you through the obstacles, onward to your clearly defined goals.

All of our clients are unique. Their financial affairs are impacted by differing family influences, levels of wealth and external realities.

© 2009-2024 Hanover Private Client Corporation | Privacy Policy